Wells Fargo Workers United

We are Wells Fargo employees forming a union to improve our working conditions;

making a better Wells Fargo for workers & customers.

Work at Wells Fargo? Join our movement.

Upcoming Events

Why we are organizing

Can bank workers belong to unions?

Yes! All bank, credit union, and other financial service workers have the right to form unions. While there are few bank workers who currently belong to unions in the United States, there have been some recent victories at Beneficial State Bank and Genesee Co-Op Federal Credit Union. Further, most workers at big banks around the world belong to unions.

What can we get from forming a union?

To take care of others, we need to take care of ourselves. Together, as a union we can negotiate for improved wages, benefits and working conditions.

How does a union work, anyway?

We are joining a democratic union. Once we unionize, a committee of workers, along with a union rep, sits down with management to bargain a contract on such issues as salary, benefits, and working conditions. Once a deal is reached, members of our union vote it up or down. Members in each job title or worksite elect shop stewards to represent their interests in an ongoing way around workplace safety, compensation, benefits, discipline, and so on. Union members also participate in the broader labor movement through demonstrations, voter drives, and lobbying. A union provides us a vehicle for making change in our workplace and in society.

Can’t we get more by just sitting down and talking individually with the boss?

Bargaining collectively is the only way to effectively negotiate “big issues” such as health insurance, living wage for all, and fair working conditions. Our managers have very little influence over our raises or working conditions. Higher level executives like our district managers or higher up are the real decision makers. If we want to improve staffing and working conditions at our locations, we need to come together so we can bargain collectively.

Proper Staffing

We need adequate staffing levels to reduce stress levels, enable humane workloads and set attainable performance metrics.

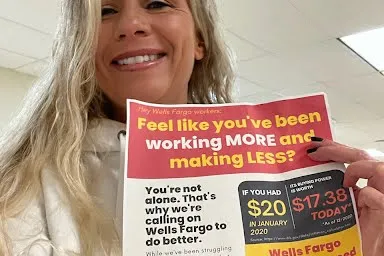

Better Pay

We want a fair raise for ALL employees commensurate with the 30% increase to the starting minimum wage.

Work Life Balance

We demand safe and flexible work arrangements along with time-off benefits that recognize all of our needs, duties and responsibilities.

Respect

Respect our right to organize an independent voice at work free from fear of retaliation or harassment.

We Are Bank Workers

As bank workers across the United States, we keep branches open, solve customers’ problems, process and underwrite loans, help families who have fallen behind on their mortgage payments, protect the bank from financial crimes and money laundering, ensure communications comply with federal regulations, help consumers obtain the financial products they need to thrive and much, much more.

We Are Fed Up

Unfortunately, too often we feel disrespected and an afterthought. We are required to solve complex customer problems and move on to the next in a few short minutes or risk disciplinary action and losing out on our incentive pay. We have to help the same volume of customers at our branch - yes many people still visit bank branches - with fewer staff. The list goes on and on.

Our Jobs Matter

Many of us have endured inhumane sales goals, performance metrics and workloads for years, including a toxic culture that caused severe damage to our mental and physical health. Some of us are newer to the bank. But we all remain dedicated to repairing Wells Fargo’s tattered reputation by turning words into action. Providing the best customer care must not be just a marketing slogan. We need the tools, support and protections that enable us to succeed.

Wells Fargo Can Change

Meanwhile, Wells Fargo authorized $18 billion in stock repurchases this year and $23 billion last year. And CEO Charlie Scharf’s total compensation of $20,392,046 is 274 times the median pay of $74,416 for the bank’s 254,000 employees. Giving all 127,000 employees who make less than the median wage a $5 an hour raise would only cost $1.32 billion, a fraction of what is typically returned to investors annually.